HDFC Ergo Health Optima Restore

HDFC Ergo Health Optima Restore Insurance Plan is a Comprehensive Online Health Insurance Plan that provides comprehensive cover for the entire family.

Key Features

Hospitalization expenses such as room rent, nursing expenses, ICU charges, surgeon’s fees, doctor’s fees, anaesthesia, blood, oxygen, operation theater charges, etc. with no sub-limits

Medical expenses incurred 60 days immediately before hospitalization will be covered. Expenses incurred up to 180 days after being discharged from the hospital such as follow-up visits to medical practitioner, medication, etc will be covered

Charges of Ambulance provided by the hospital or any service provider will be reimbursed upto Rs 2000 for each hospitalization

Medical expenses incurred by an organ donor while undergoing the organ transplant surgery if the organ is for the use of the insured person.

Medical expenses incurred by the insurer for treatment at home will be reimbursed. The medical treatment should be for a period exceeding 3 consecutive days and should merit hospitalization.

If the Sum Assured in the policy is exhausted due to claims made, then the company restores the entire sum assured once in the policy year. This restores Sum Assured amount can be used for future claims, not related to the illness / injury for which the claim has already been made during the same year.

For a Claim Free year, there is a No Claim Bonus of 50% and another 50% of No Claim Bonus for the second consecutive Claim Free year of total 100% of Basic Sum Assured

For select diseases / ailments / treatments, the Company will reimburse the cost of medical expenses, whether the insured gets these treatments anywhere in India.

- Cashless Hospitalization

- Policy Term options of 1 or 2 years with a 7.5% Discount on 2 year policy terms

- Tax benefit on premiums paid under Section 80D of the Income Tax Act, 1961

- Free look period of 15 days from the receipt of policy documents

- No caps/limits on doctor/surgery fees, operation theatre, room rent and intensive care unit

- 7.5% Discount on 2 year policy terms and more

- There is No claim based loading in this plan

- Quick turnaround time with 90% of pre-authorization is done within 2 hours of intimation or hospitalization

- Easy upgrade: This health plan also comes with an easy upgrade option on policy renewal

Benefits

- Pre-Hospitalization Coverage up to 60 Days

- Post-Hospitalization Coverage up to 180 Days

Restore Benefit where the Sum Assured is restored if it is exhausted that can be utilized for a future claim for a different illness is made during the same policy year. Thus, if the Initial Sum Assured gets exhausted, the entire amount is restored back into the plan at no extra cost!

Multiplier Benefit where there is a 50% increase of the Basic Sum Assured as No Claim Bonus and if the consecutive year is also Claim Free then the total No Claim Bonus increases by 100% with a net effect of Double the Basic Sum Assured

Day Care Procedures for 140 listed day care procedures

Emergency Ambulance Upto Rs.2,000 per Hospitalisation

Domiciliary Treatment

Organ Donor

How it works

- Restore Benefit: The Uniqueness in this plan is that in this plan, the Sum Assured is restored if it is exhausted that can be utilized for a future claim for a different illness is made during the same policy year. Thus, if the Initial Sum Assured gets exhausted, the entire amount is restored back into the plan at no extra cost!

Let us explain this with an example. If you have a Sum Assured of Rs 5 lakhs and Claim for Rs 6 lakhs in the first hospitalization, then the entire limit is exhausted and only Rs 5 lakhs would be payable. However, if another claim happens within the same year for a different illness or for a different family member, then the entire Sum Assured of Rs 5 lakhs is available for claim even though the initial Sum Assured has been exhausted.

However, the restore benefit works only if:

- The entire Basic Sum Assured is exhausted

- The claim is for a completely unrelated illness

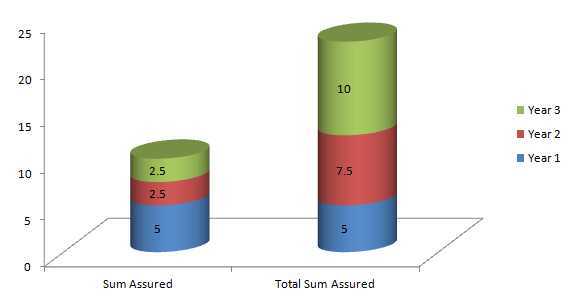

- Multiplier Benefit: Another Unique Benefit of this plan is that for a claim free year, there is a 50% increase of the Basic Sum Assured as No Claim Bonus and if the consecutive year is also Claim Free then the total No Claim Bonus increases by 100% with a net effect of Double the Basic Sum Assured.

Let us explain this with an example. If you have a 5 lakh policy and don’t claim in the first year, the cover increases to Rs 7.5 lakhs in the second year which rises to Rs 10 lakhs in the third year for another consecutive claim free year while the premium is calculated only for a premium for Rs 5 lakhs of initial Basic Sum Assured.

In case of claim, the No Claim Bonus will be reduced by 50% of the basic sum insured. However this reduction will not reduce the Sum Insured below the basic Sum Insured of the policy.

This plan provides for regular features like pre-hospitalization, hospitalization and post hospitalization expenses without any cap on charges like doctor’s fees, OT charges, etc. as well as Day Care Treatment, Domiciliary Treatment, Organ Donor costs, etc.

- Restoration of the entire Sum Insured if used in the middle of the year at no additional cost

- No claim bonus increases the insurance cover by 50% for one claim free year and then 100% for the consecutive claim free year

- Lifelong renewal to stay insured forever

- No sub-limits on hospital room rent or co-pay required

- No loading on renewal premiums if a claim is made

- Cashless treatment across 4000 hospitals in more than 800 cities

- Wide cover for treatment against illnesses and accident

- Tax benefits

Eligibility

|

|

Minimum

|

Maximum

|

|

Sum Assured (in Rs)

|

3,00,000

|

50,00,000

|

|

Policy Term (in years)

|

1

|

2

|

|

Entry Age of Life Insured (in years)

|

91 days

|

65 years

|

|

Renewable till Age (in years)

|

-

|

Lifelong

|

|

2 Years Standard Exclusion

|

For specific diseases like cataract, hernia, hysterectomy, joint replacement etc.

|

|

|

Waiting Period

|

30 Days

|

|

|

Waiting Period for Pre-existing Illness

|

After continuous renewal of 3 years

|

|

|

Grace Period

|

30 days from the date of expiry to renew the policy

|

|

Exclusions

- Any treatment within first 30 days of cover except any accidental injury

- Any Pre-existing diseases/conditions will be covered after a waiting period of 3 years

- 2 years of exclusion for specific diseases like cataract, hernia, hysterectomy, joint replacement etc.

- Expenses arising from HIV or AIDS and related diseases

- Abuse of intoxicant or hallucinogenic substance like drugs and alcohol

- Pregnancy, dental treatment, external aids and appliances

- Hospitalization due to war or an act of war or due to nuclear, chemical or biological weapon and radiation of any kind

- Non-allopathic treatment, congenital diseases, mental disorder, cosmetic surgery or weight control treatments

FAQs

The individual or family floater health insurance works on the principle of indemnity. This means that these insurance policies will pay you only what you have spent for medical treatment in hospital. On the other hand, the critical illness or the hospital cash insurance pays you the amount insured, irrespective of the amount spent for medical treatment. These are a benefit based policies.

You may be required to undergo a medical check-up after you buy, in case any member to be insured is above 45 age or for sum insured 7 Lakhs or above.

Buying an individual cover or a floater cover is an individual’s perception. However, as a general rule, at younger ages floater cover is advisable. As you grow older, you should go for an individual cover.

- Proposal form

- Portability form

- Last 3 year’s copy of expiring health insurance policy

- Copy of renewal notice