LIC Jeevan Vaibhav

LIC Jeevan Vaibhav Plan is a single premium endowment plan. It offers guaranteed benefits on death and maturity along with loyalty additions. This is a non-participating plan and therefore there is no bonus facility in this policy.

Key Features

Sum assured + Loyalty Additions is paid on Maturity or Death in the last policy year

Sum assured would be paid as Death Benefit if the life insured dies within the policy tenure, but before the last policy year

Benefits

In case of death of the Life Insured within the policy tenure but in the last policy year, the nominee receives Sum Assured + Loyalty Additions as Death Benefit and the policy is terminated.

In case of death of the Life Insured within the policy tenure but before the last policy year, then the nominee receives only the Sum Assured as Death Benefit and the policy is terminated.

At the policy maturity the Life Insured would get Sum Assured + Loyalty Additions as Maturity Benefit.

Premiums paid under life insurance policy are exempted from tax under Section 80 C and maturity proceeds are exempted from tax under Section 10 (10D)

How it works

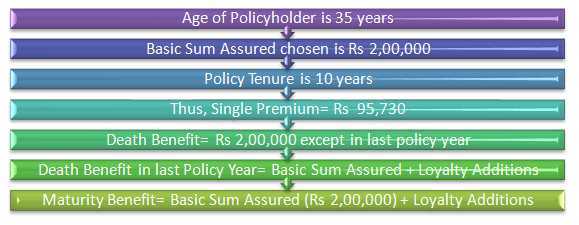

In this plan, premium needs to be paid in a lumpsum as single premium. At the end of the policy tenure, the Sum Assured along with Loyalty Additions would be paid as Maturity Benefit.

However, if the Life Insured dies within the policy tenure but before the last Policy Year, only the basic Sum Assured would be paid as Death Benefit and the policy would be terminated.

If the Life Insured dies in the last Policy Year, then the Sum Assured + Loyalty Additions would be paid as Death Benefit and the policy would be terminated.

Sample illustration of premium of LIC Jeevan Vaibhav Plan:

The below illustration is for a healthy Male (non-tobacco user) opting for a Sum Assured = Rs 1,00,000

Eligibility

| Minimum | Maximum | |

| Sum Assured (in Rs.) | 2,00,000 | No Limit |

| Policy Term (in years) | 10 | |

| Premium Payment Term (in years) | Single | |

| Entry Age of Life Insured (in years)

|

8 | 65 |

| Age at Maturity (in years) | - | 75 |

| Single Premium (in Rs.) | 95,210/- | No Limit |

| Payment modes | Only Single | |

FAQs

If you stop paying the premiums after 3 policy years, the policy lapses and all benefits cease to exist.

There is a Guaranteed Surrender Value after 1 policy year

Guaranteed Surrender Value = 90% of the Single Premium paid

There is Special Surrender Value also in this plan.

Loan facility is available under this policy after completion of 1 policy year.

Let us understand the working of this plan diagrammatically with an example of a 35 year old man opting for Basic Sum Assured of Rs 2,00,000.

There are No Additional Riders in this plan