Key Features

Choice of protection cover basis age of the Life Insured

Benefits

On maturity, you will be eligible to receive an amount, provided settlement option has not been exercised, equal to the Fund Value, where the Fund Value will be calculated as:

Fund Value = Summation of Units accumulated in Fund(s) X NAV of respective Fund(s) as on the Maturity Date

Please Note: In case the Maturity Date is a non working day for the Company or markets then next working day's NAV will be applicable.

In case of Death of the Life Insured anytime during the term of the Policy, Sum Assured plus the Fund Value as on the date of death, subject to a minimum of 105% of all premiums paid till the date of death, shall be payable.

Minimum Sum Assured- Rs. 385000

Maximum Sum Assured- No Limit, subject to underwriting, as per the Board approved underwriting policy of the Company

Investment Options: Any of the Five (5) Funds or Dynamic Fund Allocation Option

Growth Super Fund (SFIN: ULIF01108/02/07LIFEGRWSUP104)

Growth Fund (SFIN: ULIF00125/06/04LIFEGROWTH104)

Balanced Fund (SFIN: ULIF00225/06/04LIFEBALANC104)

Conservative Fund (SFIN: ULIF00325/06/04LIFECONSER104)

Secure Fund (SFIN: ULIF00425/06/04LIFESECURE104)

How it works

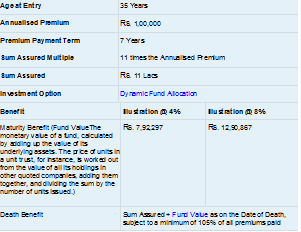

Let's look at an example based on a standard male life

Kindly note that the scenarios shown above are only illustrations and do not in any way create any rights and/or obligations. The actual experience on the contract may be different from the one shown above. The non-guaranteed rates mentioned above relate to the assumed investment return at different rates and may vary depending upon the market conditions. The taxes and cesses on charges would be deducted through cancellation of units. Please note that the above assumed rates of return, 4% and 8% respectively, for Dynamic Fund Allocation Investment Option and Sum Assured Multiple of 11, are only scenarios of what your policy will look like at these rates after recovering all applicable charges.These are not guaranteed and they are not the upper or lower limits of returns of the Fund Option selected in your policy, as the performance of the Funds is dependent on a number of factors including future investment performance. Applicable taxes , cesses, and any other taxes as imposed by the government from time to time will be deducted from the premium received. For more information, please request for your Policy specific benefit illustration.

Eligibility

Minimum/ Maximum Age of Life Insured at Entry (Age as of Last Birthday) Minimum Entry Age : 18 years

Maximum Entry Age : 55 years

Maximum Maturity Age of the Life Insured (Age as of Last Birthday) 70 years

Surrender Value

At any time during the Policy Term, you have the right to surrender the policy by advising the Company in

writing.

Surrender within five years of Effective Date of the Policy (i.e. within the Lock-in Period) In case you surrender the policy within the lock-in-period, the Company will credit the Fund Value by creation of Units into the Discontinued Policy Fund after deducting applicable Surrender / Discontinuance Charges.

At the expiry of five years from the effective date of the Policy (i.e. at the expiry of the Lock-in Period), the Company will close the Unit Account and pay you the value of Units in the Discontinued Policy Fund as at that date.

From the Date of Discontinuance, the risk cover under the policy will stop and no further charges will be levied by the Company other than the Fund Management Charge applicable on the Discontinued Policy Fund i.e. 0.5% per annum currently.

In case the Life Insured dies anytime after the Date of Discontinuance, the Company shall pay the Fund Value as on the date of death.

Surrender after five years of Effective Date of the Policy (i.e. after the completion of Lock-in Period) The Company shall close the Unit Account and pay the Fund Value of the Units in the segregated Fund(s) on the date of receipt of surrender request and the policy shall terminate thereafter.

You are not entitled to any loan under this Policy

If the Regular Premium is not received by the expiry of the Grace Period, We will, within 15 (Fifteen) days of the expiry of the Grace Period, give a written notice to You to exercise one of the following options in writing within 30 (Thirty) days of the receipt of such notice (“Notice Period”):

revive the Policy within the Revival Period;

complete withdrawal (i.e. surrender) of the Policy without any risk cover.

You giving the Company a written request to revive the policy; and

The Life Insured producing evidence of insurability at your own cost acceptable to the Company as per the Board approved underwriting policy of the Company; and

You paying the Company all overdue contractual premiums.