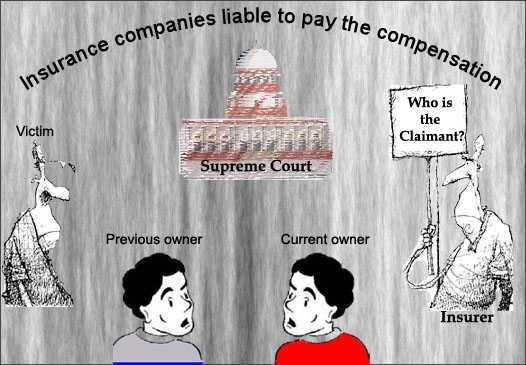

In what comes as a big relief to many auto insurance policyholders, the apex court passed a ruling that insurers are liable to compensate for the loss during a third-party motor insurance claim even if there is a change in the ownership of the vehicle.

This ruling passed by the Supreme Court was directed to National Insurance Company, which is one of the four non-life public sector insurance companies in India. On 13th June 1998, a minibus hired by the UP State Road Transport Corporation engaged in an accident taking the lives of one person and three children. The claim with National Insurance was stuck because the vehicle was owned by a private party and only hired by the UPSRTC. Finally, the Supreme Court directed asking National Insurance to compensate Kulsum, the widow of the victim, and passed a ruling that made the insurance companies liable to pay the compensation to the claimant even though the vehicle ownership was transferred.

The Supreme Court bench represented by Justice Dalveer Bhandari and Justice Deepak Verma, expressed that motor insurance has been mandated by law for a social objective which is to protect the third-party victims and the same had to be maintained.

Justice Verma said, “The liability to pay compensation is based on a statutory provision. Compulsory insurance of the vehicle is meant for the benefit of third parties. The liability of the owner to have compulsory insurance is only in regard to the third party and not to the property. Once the vehicle is insured, the owner as well as any other person can use the vehicle with the consent of the owner. Section 146 of the Act does not provide that if any person uses the vehicle independently, a separate insurance policy should be taken. The purpose of compulsory insurance in the Act has been enacted with an object to advance social justice.”