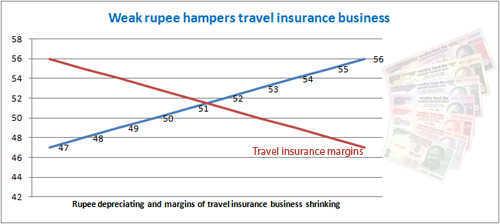

The depreciating rupee is causing a headache to all the non-life insurance companies in India with respect to their travel insurance portfolio. The fall in domestic currency has affected the profitability of both private and public-sector general insurance companies.

The claims in a travel insurance policy are denominated usually in dollar or some other foreign currency. Because of a weak rupee, the claim amounts paid out are high and it will go up further denting the margins of non-life insurance companies. Experts suggest that the dollar is going to further depreciate to Rs.60. Moreover, this period from March to July is the best season for travel insurance business. This fear of weak rupee is forcing insurance companies to revise premiums of their travel insurance policies.

Non-life insurance companies such as United India, National insurance, ICICI Lombard, Tata AIG and many others are feeling the shocks already and are planning to approach the insurance regulator IRDA for permission to hike the premiums at the earliest.