LIC Jeevan Tarun Plan (934)

LIC Jeevan Tarun (934) Review

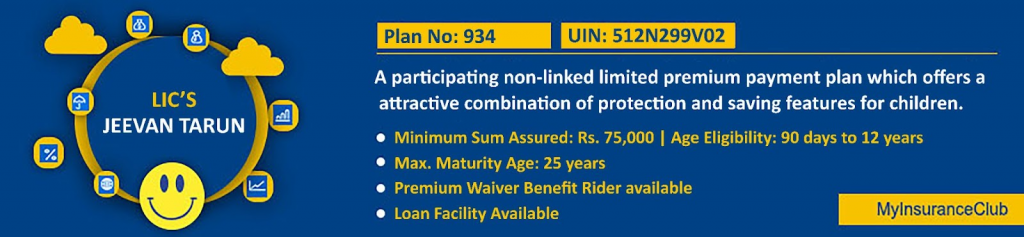

LIC Jeevan Tarun (Table No. 934) is a Non-linked, Participating, Individual, Life Assurance savings plan for children which offers an attractive combination of protection and saving features. This plan is specially designed to meet the educational and other needs of growing children through annual Survival Benefit payments from ages 20 to 24 years and Maturity Benefit at the age of 25 years. We will understand this plan in detail below.

| Launch Date | 1st February 2020 |

| Table Number | 934 |

| Product Type | Money Back, Child Plan |

| Bonus | Yes |

| UIN | 512N299V02 |

Benefits

The death cover actually starts only after the “Date of commencement of Risk”. In case the child is less than 8 years of age when taking the policy, the risk cover will start either one day before the completion of 2 years from the date commencement of policy or one day before the policy anniversary coinciding with or immediately following the completion of 8 years of age, whichever is earlier.

- In case the policyholder dies before the “Date of commencement of Risk”, all premiums paid till now will be returned. This does not include the tax amounts paid or any rider premium which has been paid.

- In case the policyholder dies after the “Date of commencement of Risk”, the higher of 10 times the annual premium or 125% of Sum Assured along with the Simple Reversionary Bonus and Final Addition Bonus which has been declared will be paid.

This will depend on the Plan Option which has been selected.

| Policy Anniversary coinciding with/ following completion of ages |

Percentage of Sum Assured to be paid as Survival Benefit |

|||||

| Option 1 | Option 2 | Option 3 | Option 4 | |||

| 20 to 24 years | Nil | 5% each year |

10% each year |

15% each year |

||

This will also depend on the Plan Option selected.

| Maturity Age | Option 1 | Option 2 | Option 3 | Option 4 |

|---|---|---|---|---|

| 25 years | 100% of Sum Assured | 75% of Sum Assured | 50% of Sum Assured | 25% of Sum Assured |

Along with this, the Simple Reversionary Bonus and the Final Addition Bonus as declared will be paid to the policyholder.

If the policyholder is not happy with the plan, he can cancel the policy within 15 days of the plan issuance. This period is called the free-look period. Upon cancellation, the premium paid net of any applicable expenses would be returned. To know more about the Free-Look Period, click here.

In the case of Yearly, Half-yearly, and Quarterly premium payment modes you have a grace period of 30 days from the premium due date. In the case of monthly premium payment mode, the grace period is 15 days.

You can avail a loan against this policy after you have paid 2 years of premium.

You have the choice of taking the following rider by paying an extra premium amount:

- LIC's Premium Waiver Benefit Rider (UIN: 512B204V03)

If you surrender the plan anytime before paying 2 years of premiums, you will not be paid anything back. In case you have paid at least 2 years' premiums, the policy will acquire a Surrender Value. The bonus which you get in the policy also has a surrender value. Click here to understand the Surrender Value Calculations in the LIC Jeevan Tarun Plan.

How it works

When buying the LIC Jeevan Tarun Plan, the customer has to decide on the following:

- Sum Assured is the amount of coverage that you want. You can choose a minimum amount of Rs. 75,000. There is no upper limit.

- Policy Term is the period you wish to have the cover. The term will end when the child reaches the age of 25 years.

- Premium Payment Term is the term for which you need to pay premiums until the child reaches the age of 20 years.

You have to select one of the following options to decide how you want to get the benefits:

| Option | Money Back Options | Maturity Benefit |

|---|---|---|

| Option 1 | No Money Back during policy term | 100% of Sum Assured |

| Option 2 | 5% of Sum Assured for the last 5 years | 75% of Sum Assured |

| Option 3 | 10% of Sum Assured for the last 5 years | 50% of Sum Assured |

| Option 4 | 15% of Sum Assured for the last 5 years | 25% of Sum Assured |

We will understand these options better with the help of examples.

Based on the amount of cover, your child’s age, and how you want to receive the benefits, your annual premium will be decided.

Since it is a Participating plan, you will receive Simple Reversionary Bonus and Final Additions as and when declared by LIC.

Tax Benefit

- Premiums – The premiums paid for the plan are exempt from taxation under Section 80C of the Income Tax Act.

- Maturity Claim – Maturity amount is exempted from tax under Sec 10(10D) of the Income Tax Act

- Death Claim – Death claims received under the plan are free from taxation under Section 10(10D) of the Income Tax Act

Claim Process

Suresh Yadav, age 35 who wishes to buy this plan for his 2-year-old daughter Ashmita. He goes in for the plan with the following:

Sum Assured - Rs. 5,00,000

Premium Paying Term - 18 years (Till Ashmita reaches the age of 20)

Policy Term - 23 years (When Ashmita reaches the age of 25 years)

Variant - Option 1

Based on the above parameters, the annual premium is Rs. 22,804 + Taxes = Rs. 23,831. Here we have assumed the current tax rate of 4.5%.

Maturity Benefit:

After Ashmita turns 25 -

Total Premiums Paid - Rs 4,28,958

Sum Assured (A) - Rs 5,00,000

Simple Reversionary Bonus (B) + Final Additional Bonus (C) = Rs 7,80,000 + Rs 50,000 = Rs 8,30,000

Maturity Amount = (A) + (B) + (C) = Rs 13,30,000

Death Benefit:

In case of child’s demise -

Guaranteed Life insurance (A) - Rs 6,25,000

As on death bonus paid: Accumulated Bonus (B) + FAB (C) - Rs 8,30,000

Death Benefit = (A) + (B) + (C) = Rs 14,55,000

Variant - Option 2

Based on the above parameters, his annual premium is Rs. 23,392 + Taxes = Rs. 24,444. Here we have assumed the current tax rate of 4.5%.

Maturity Benefit:

After Ashmita turns 20 - 5% of the sum assured - Rs. 25,000

After Ashmita turns 21 - 5% of the sum assured - Rs. 25,000

After Ashmita turns 22 - 5% of the sum assured - Rs. 25,000

After Ashmita turns 23 - 5% of the sum assured - Rs. 25,000

After Ashmita turns 24 - 5% of the sum assured - Rs. 25,000

After Ashmita turns 25 - 75% of the sum assured - Rs. 3,75,000

Simple Reversionary Bonus + Final Additional Bonus = Rs 7,80,000 + Rs 50,000 = Rs 8,30,000

Total Maturity Amount on 25th year of the policy - Rs 13,30,000

Death Benefit:

In case of child’s demise -

Guaranteed Life insurance - Rs 6,25,000

As on death bonus paid: Accumulated Bonus + FAB - Rs 8,30,000

Death Benefit - Rs 14,55,000

Similarly, the working of other options can be deduced.